What this puppy chatbot says about the friendly future of fintech for consumers - garaybrohn1967

This puppy chatbot is the most lovable example yet of the anticipat of fintech.

Fintech is a blanket term for financial technologies. Fintech ranges from the payment and banking apps many of us already apply, to the AI and machine-learning applications that crunch transactional information for financial companies, to cryptocurrency, blockchain, and other ended atomic number 75-imaginings of how money works. At Intuit's Innovation Lab Wednesday night in San Francisco, the puppy was unitary of several experiments shown past the companionship's developers that explore how consumers could know fintech in their regular lives—and mayhap bear more fun with managing money.

A puppy (or kitten) that cares

Genus Melissa Riofrio/IDG

Genus Melissa Riofrio/IDG Intuit's experimental chatbot commercial enterprise assistant could take on many personas, including this cute kitty.

The pup chatbot, along with a kitty and or s human-like characters, are an experiment in what Intuit titled empathetic virtual assistants. Configured to present a well-disposed face for answering your financial questions, these chatbots buns converse using natural language and express one of six emotions based on how you appear to be flavour when you call.

Cindy Osmon of Intuit demonstrated with a chatbot that looked like a young Asian woman. As Cindy asked questions and presented problems, the chatbot's expression shifted from awake care to concern to grin solution.

Melissa Riofrio/IDG

Melissa Riofrio/IDG Cindy Osmon of Intuit converses with a chatbot who's trained to answer commercial enterprise questions and express mail emotions supported on what you say.

The chatbots' emotions are exactly mimicry, and they're working with a script. Smooth, their ability to appear somewhat serious could make a customer more likely to discuss their problem and assume suggested solutions.

A class into developing this concept, training the chatbot to react befittingly to people's emotions stiff a big take exception, Osmon admitted. "We're using third-party analysis to determine whether a doom is melancholic or happy," she explained, "but text-to-speech isn't enough. We're looking at vocal patterns too." Even at this early present, the chatbot's smiles, frowns and slow eye-blinks clearly engaged and disarmed spectators—and that could be a way to fitter technical school-support calls.

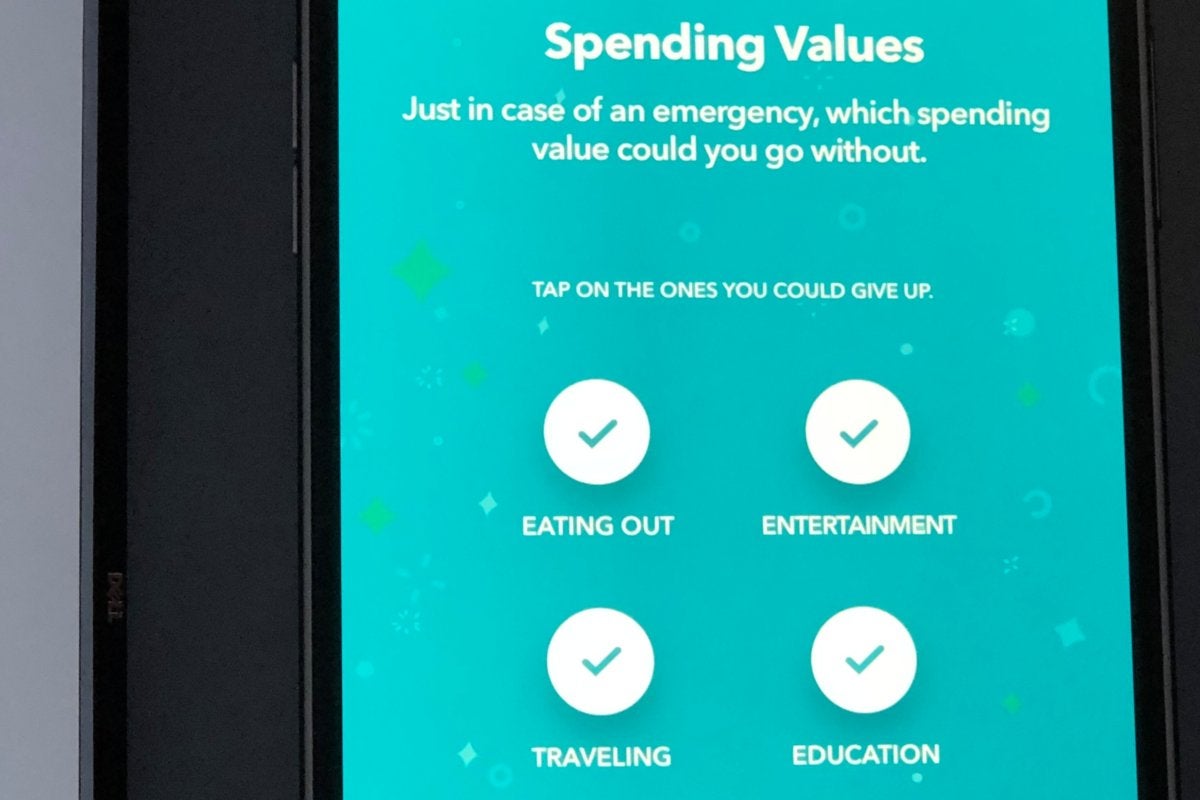

A friendly business enterprise app

Melissa Riofrio/IDG

Melissa Riofrio/IDG Intuit's Shield app helps populate reach financial goals away setting priorities and encouraging responsible behaviors.

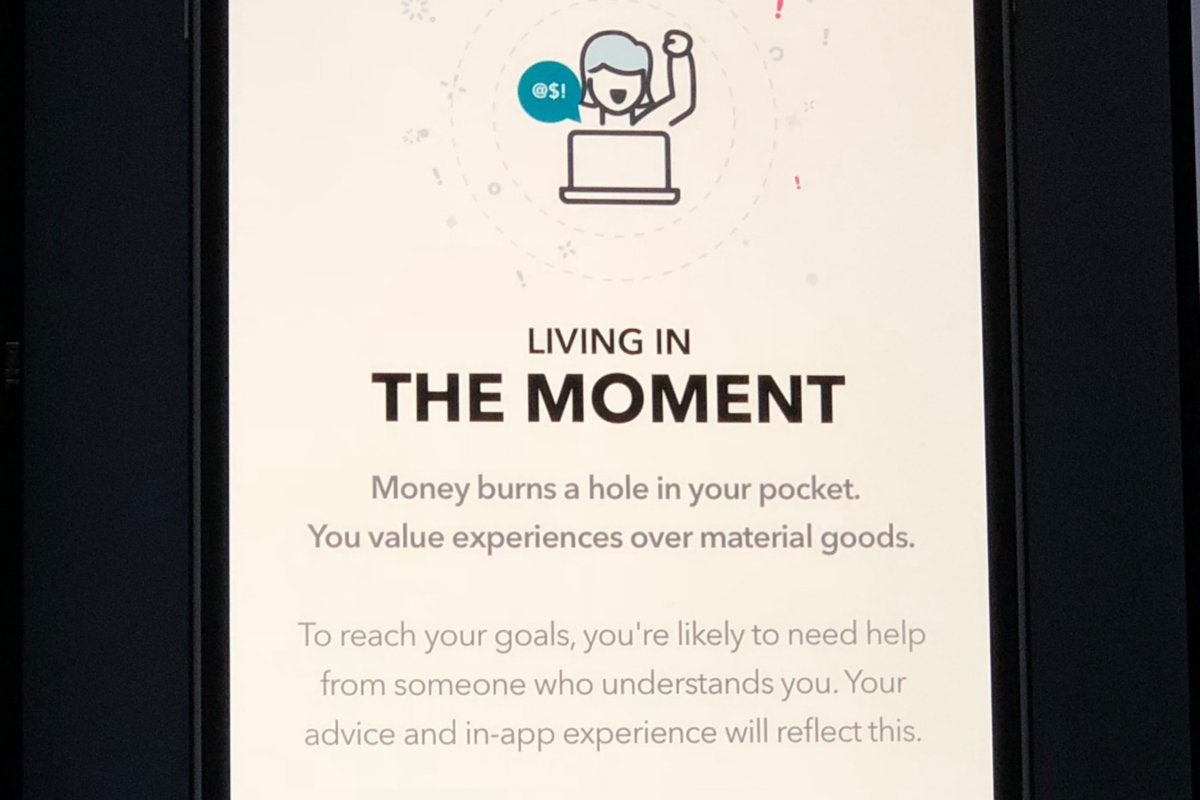

Friendliness defined another demonstration victimization an app called Screen. Its job is to inject a bit amusive into the process of making meliorate financial decisions.

Intuit's Sumayah Rahman showed how the app uses quizzes to delimitate your spending style and analyze your financial spot. Armed with this information, the app tush help you set useful goals, such as building up an emergency investment firm.

Melissa Riofrio/IDG

Melissa Riofrio/IDG Take a test to obtain outgoing your financial style, and Intuit's experimental app will adjust its advice accordingly.

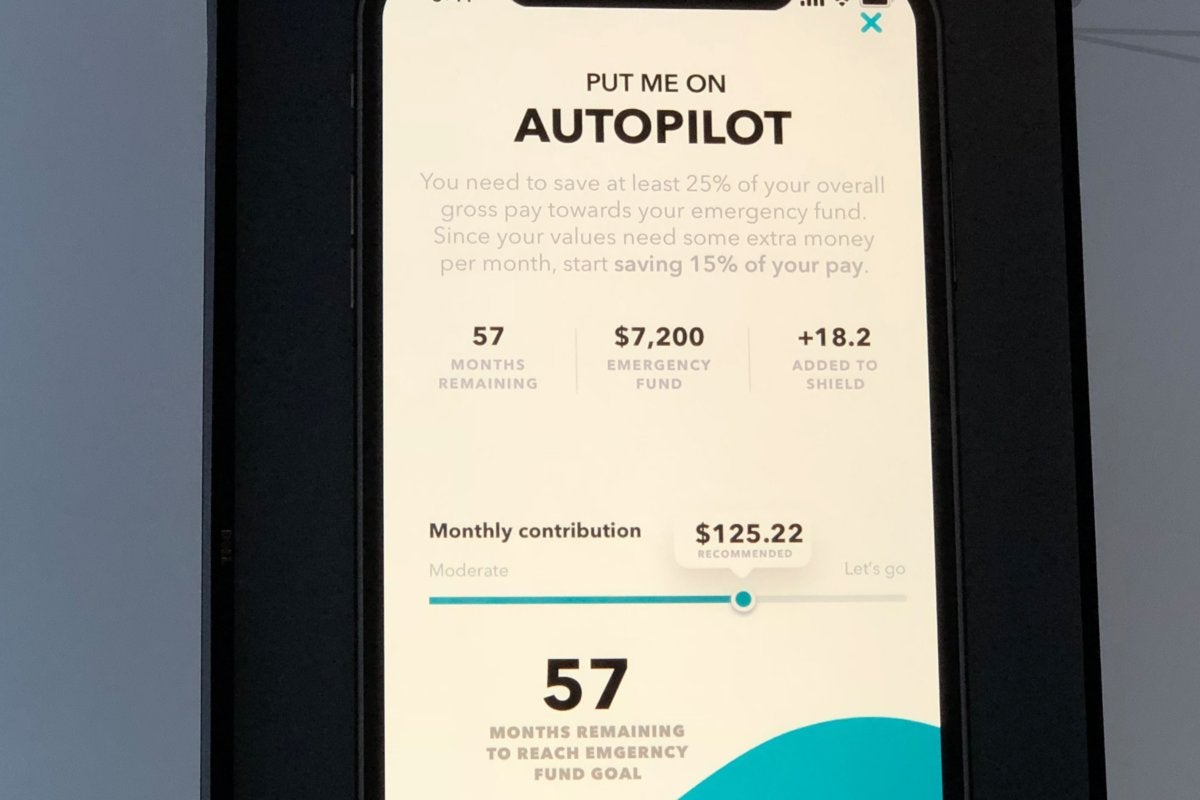

The fictional demo customer, a childly cleaning woman named Lily, is an impulsive spender WHO likes to indulge in multiethnic activities and essentially has none money saved up. Rahman showed how the app could nudge Lily toward extraordinary financial targets and go far easier to meet them away routing money automatically from Lily's paycheck into a savings account.

Melissa Riofrio/IDG

Melissa Riofrio/IDG Intuit's Shield app can be used to reach business enterprise goals through automated actions and simple encouragement.

What the app and chatbot experiments have in common is the attribute touch. Intuit's goal is to economic consumption AI and machine learning to tailor its financial planning and direction services to the individual and bolster customer engagement. The more prosperous someone feels using a product, the more they'll use information technology, Intuit hopes. This greater comfort could lead to better financial behavior, and it could also create opportunities for Intuit to sell multitude loans and other financial products, naturally.

Genus Melissa Riofrio/IDG

Genus Melissa Riofrio/IDG The Intuit Innovation Lab panel discussion included (left to rightfulness) Nan Boden of Google; Ashok Srivastava of Intuit; Swati Bhatia of PayPal; and Bharath Kadaba of Intuit. Ben Lorica of O'Reilly Media moderated the panel.

PayPal executive Swati Bhatia summed up the purpose of the helpful app, the disarming puppy chatbot, and other experiments during a empanel treatment at the event. "What would it hold fiscal services to be embedded so deeply that it's almost invisible? Trust and gizmo. We can just get to this possible future if users trust their business companies."

It's interesting how "trust" in business enterprise services put-upon to be expressed away images of stability, such as rocks and large animals and imposing buildings. In the refreshing age of fintech, it's puppies and kittens and friendly apps, reaching out to customers in a way that's much more lively and muzzy.

Source: https://www.pcworld.com/article/402173/puppy-chatbot-fintech.html

Posted by: garaybrohn1967.blogspot.com

0 Response to "What this puppy chatbot says about the friendly future of fintech for consumers - garaybrohn1967"

Post a Comment